The year in Intent report – 2025

Welcome to the year in Intent 2025

Bombora’s year-end Intent wrap-up showcases the high-impact trends that defined 2025 as revealed in B2B research across thousands of trusted publisher and website sources. This report uncovers the critical subjects that businesses cared most about this year – in the categories of cybersecurity, finserv, AI, telecommunications, consulting, SaaS, and more. The spikes in B2B research presented in this report align closely with the year’s most consequential business and news events, including major data breaches, pivotal legislative moments, and even a collapse in the earth’s magnetic shield – underscoring the accuracy and reliability of our Intent data.

Understanding this year’s top trending topics empowers you to move forward into the new year armed with insights. We hope this report also inspires you to dig deeper into Bombora’s Intent data in 2026 to transition your GTM strategies into predictive and impactful actions.

2025’s top trending topics

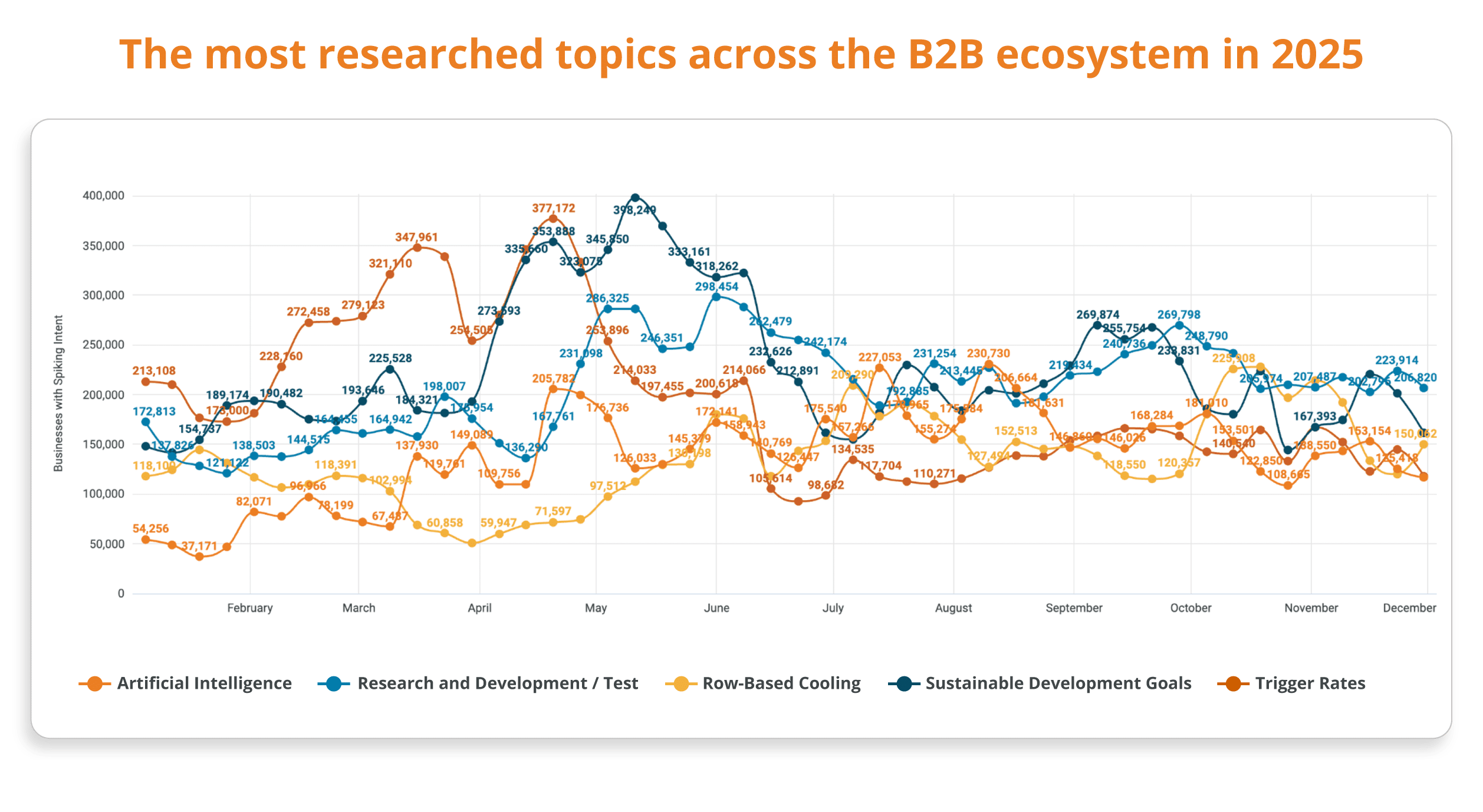

In the rapidly evolving B2B landscape, staying ahead of emerging trends is crucial for strategic success. Our deep dive into Company Surge® data has pinpointed the subjects driving the most significant surge in B2B research activity in 2025. These are the top five topics from our findings:

Sustainable Development Goals

There was extremely active interest in Sustainable Development Goals (SDG) among businesses in 2025. In May, the US backed away from SDG priorities as detailed in this article from Harvard Law School Sustainability Without the SDGs: US Policy Shifts and Corporate ESG. For many companies, this national shift propelled a new focus on market-driven sustainability or scaled back sustainability efforts.

In 2025, the UN also launched its SDG Report 2025, revealing that while millions improved lives, progress on their 2030 agenda has been insufficient, as the world faces crises like climate change, geopolitical conflicts, and debt, with only 35% of its SDG targets on track.

Artificial Intelligence (AI)

AI continues to dominate conversations in the B2B space. In 2025, AI saw a pivotal shift from widespread experimentation to a demand for measurable return on investment and scalable deployment. AI adoption reached new heights, with up to 89% of enterprises using AI tools in at least one business function. Global AI spending approached $200 billion, and investments in generative AI applications specifically grew nearly eightfold from the previous year.

Research & Development (R&D)

Businesses in June were preparing for substantial changes to U.S. R&D tax policy in anticipation of the One Big Beautiful Bill Act (OBBBA), which was signed into law in early July 2025. The bill allowed businesses to immediately expense domestic R&D costs incurred in 2025 and beyond, reversing the previous capitalization requirement that had been in effect since 2022.

The general push for American manufacturing has been a core part of the Trump administration’s platform, and several companies announced massive domestic investment plans that included R&D components this year.

Row-based Cooling

AI data center construction boomed in 2025, creating a growing need for efficient ways to cool high-density IT loads. Row-based cooling places cooling units within server rack rows, not around the perimeter, providing targeted cooling by shortening airflow paths, saving energy, and allowing for flexible, scalable deployments, which is crucial for modern, powerful hardware like AI servers. The topic steadily climbed in interest in 2025.

Trigger Rates

In April and May 2025, mortgage trigger rates experienced significant volatility, initially dipping below 6.5% in early April before rising again due to economic uncertainty, the Federal Reserve’s “wait-and-see” policy, and inflation fears. The Fed held rates steady in May amidst concerns about inflation and increased unemployment risks, keeping rates generally in the 7% range with upward pressure.

Trending AI brands

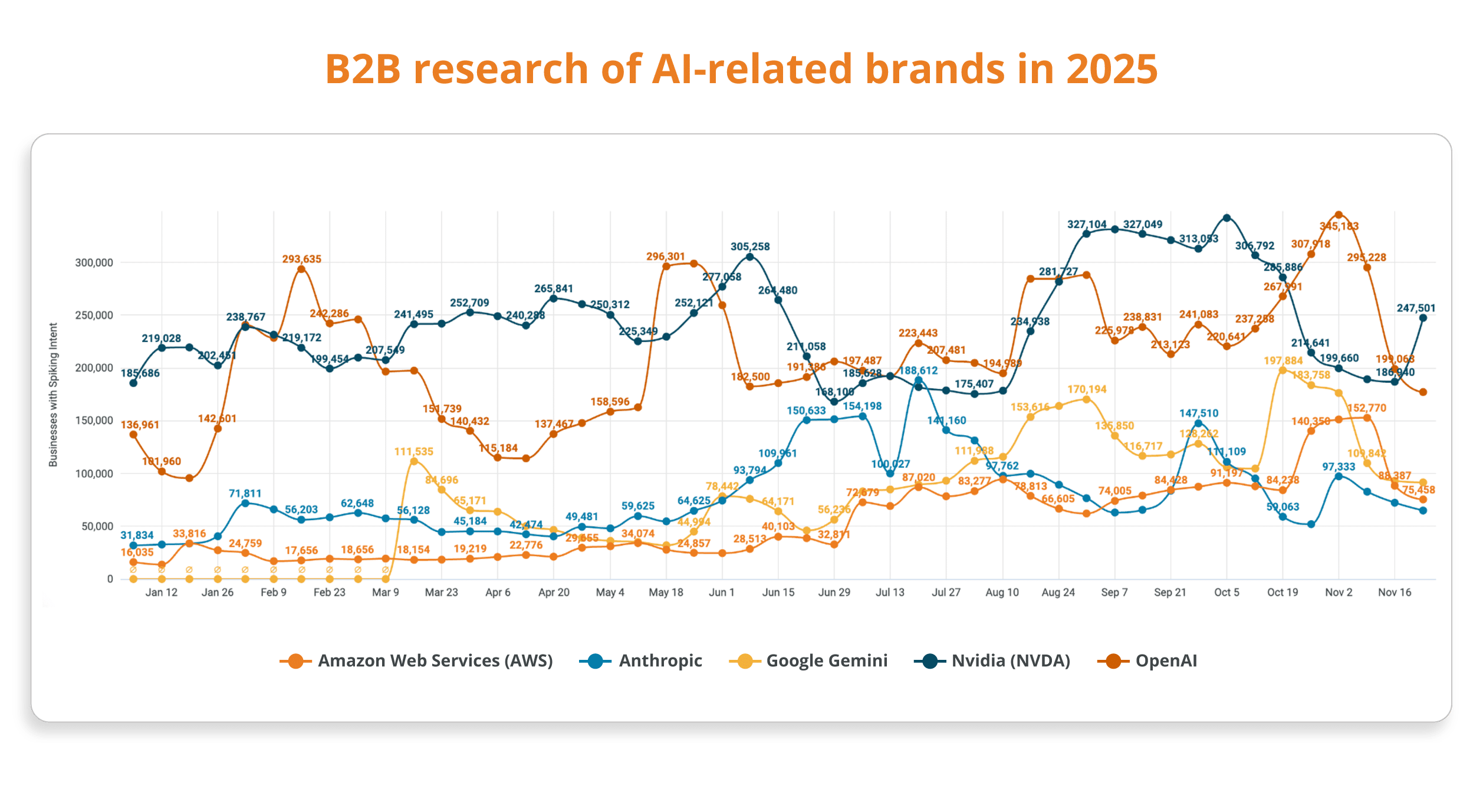

Big-tech milestones mirrored in B2B research

When it comes to AI-related searches in 2025, we see two of the most recognized names in tech coming to the fore – OpenAI and Nvidia. Not only have these two companies been leaders in the stock market in 2025, but their business operations went through significant changes this year. But peaks can be seen during significant events for both.

In October 2025, OpenAI finalized its conversion into a for-profit public benefit corporation, the OpenAI Group PBC, and interest in the company saw a large spike as the greater business community followed the story. In October 2025, Nvidia experienced a significant market event when it became the first company to reach a $5 trillion market capitalization – leading to intense interest in the company.

But what about Anthropic?

In June 2025, a significant legal ruling was made in which a judge ruled that Anthropic’s use of lawfully acquired books to train its AI was a “fair use,” but using pirated books was not. This type of copyright lawsuit can have significant impact on companies developing or using LLMs, and the uptick in B2B research reflects that.

Research of Google Gemini was mostly on an upswing in 2025, with a spike in August reflecting upgrade announcements including the release of Nano Banana, its image generation model.

As the world’s leading cloud computing platform, Amazon Web Services (AWS) provides essential infrastructure needed to build and scale AI and machine learning (ML) solutions. Interest in AWS was consistent in 2025, with a lift in October/November after a major outage in late October.

Top Finserv research

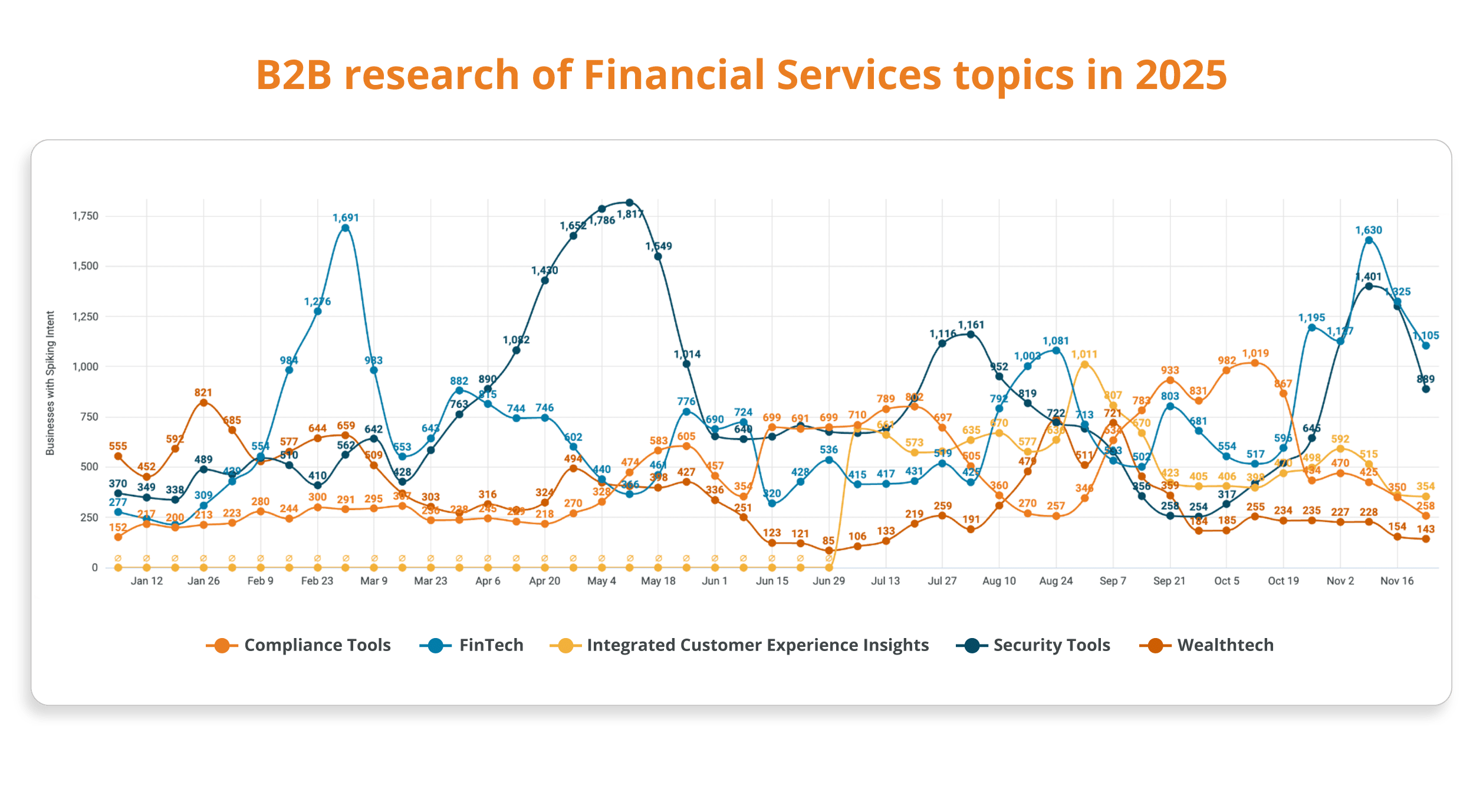

Major data breaches lead to year’s biggest topic spike

When it comes to topics being researched in the financial services sector, one topic shows a very significant spike in May – “Security tools.” Looking back on the month, there were several major financial services security breaches that generated interest in that topic:

- On May 11, Coinbase was the target of a data breach affecting approximately 70,000 customers, caused by a social engineering and bribery scheme targeting third-party support staff.

- On May 22, a hacker stole approximately $223 million in cryptocurrency, exploiting a vulnerability in a shared smart contract library used by Cetus.

- On May 28, Cork Protocol, a decentralized finance (DeFi) platform suffered a $12 million smart contract exploit that was executed in under 17 minutes.

In the FinTech space, February was an active month, leading to spiking interest in the sector. During the month Global FinTech funding fell from USD 2.66 billion in January to USD 2.06 billion in February, BNY announced a multi-year partnership with OpenAI to accelerate its AI transformation, FinTech LIVE Singapore was held, and publicly traded FinTech stocks experienced a sell-off.

Interest in FinTech spiked again in November when there were major developments, including Ramp’s $300 million raise and Kraken’s $800 million funding, along with a significant move into crypto by Klarna with its KlarnaUSD stablecoin.

Conclusion

Intent data is an essential resource not only to enable businesses to discover in market accounts and customize messaging based on interests, but also to identify directional signals and shifting priorities within the marketplace. By examining the key B2B research trends of 2025, this data report showcases the power of Intent signals to illustrate businesses’ current priorities, concerns, and future strategic direction.

To learn more about Bombora Intent data, contact us.

Want more Year in Intent Insights?

Get the full report to explore additional research across cybersecurity, SaaS, telecommunications, and more.

Get the report