Intent data trends: RTO versus remote work

Bombora Intent data can be used predictively in powerful ways, including revealing trending topics that are of critical importance across the B2B ecosystem. Because we continually track businesses’ interactions with over 18,000 topics, we can see trends develop in real time and uncover research spikes as they are happening – no other Intent data provides this universal view of B2B research.

Can Intent data predict whether a company is considering in-office requirements for employees?

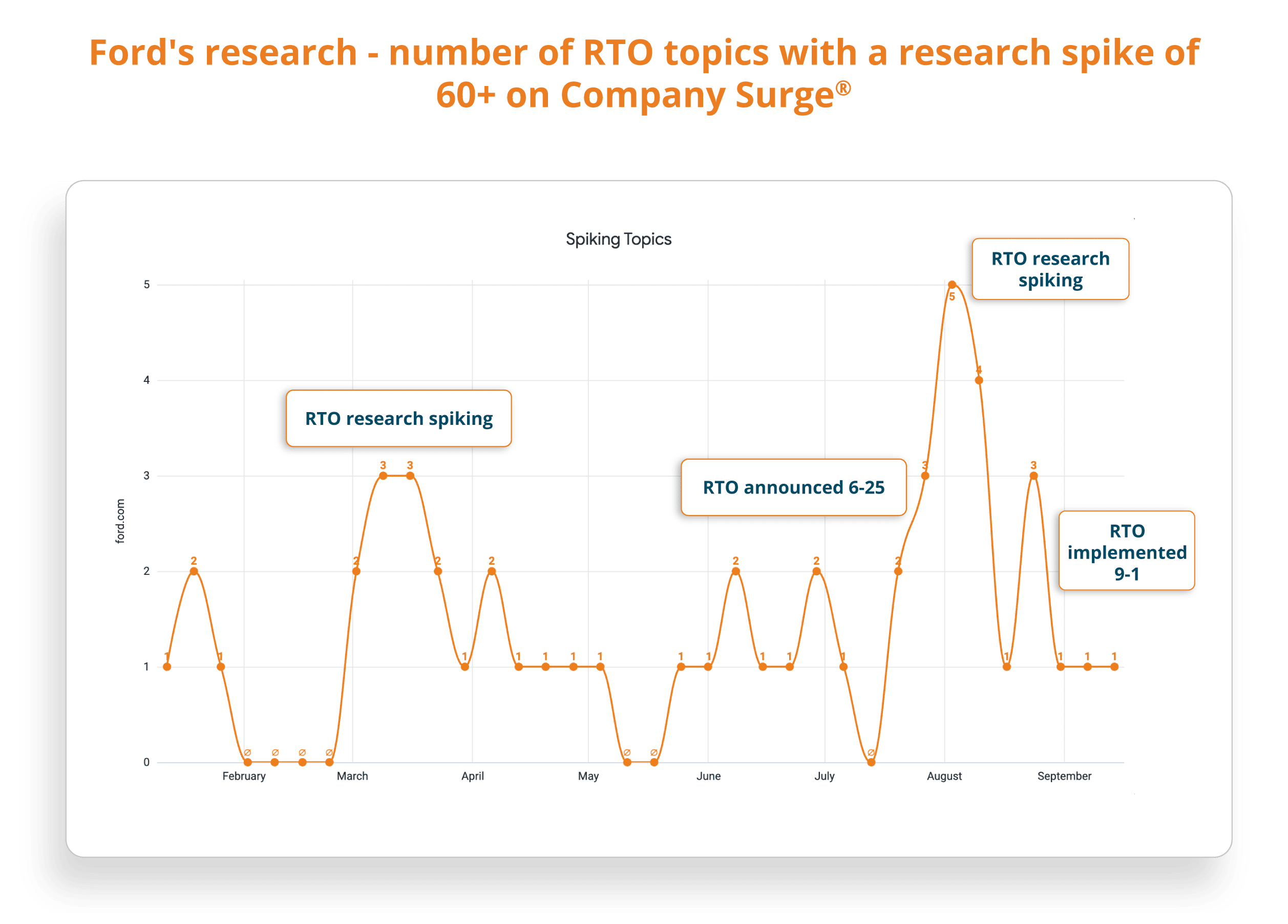

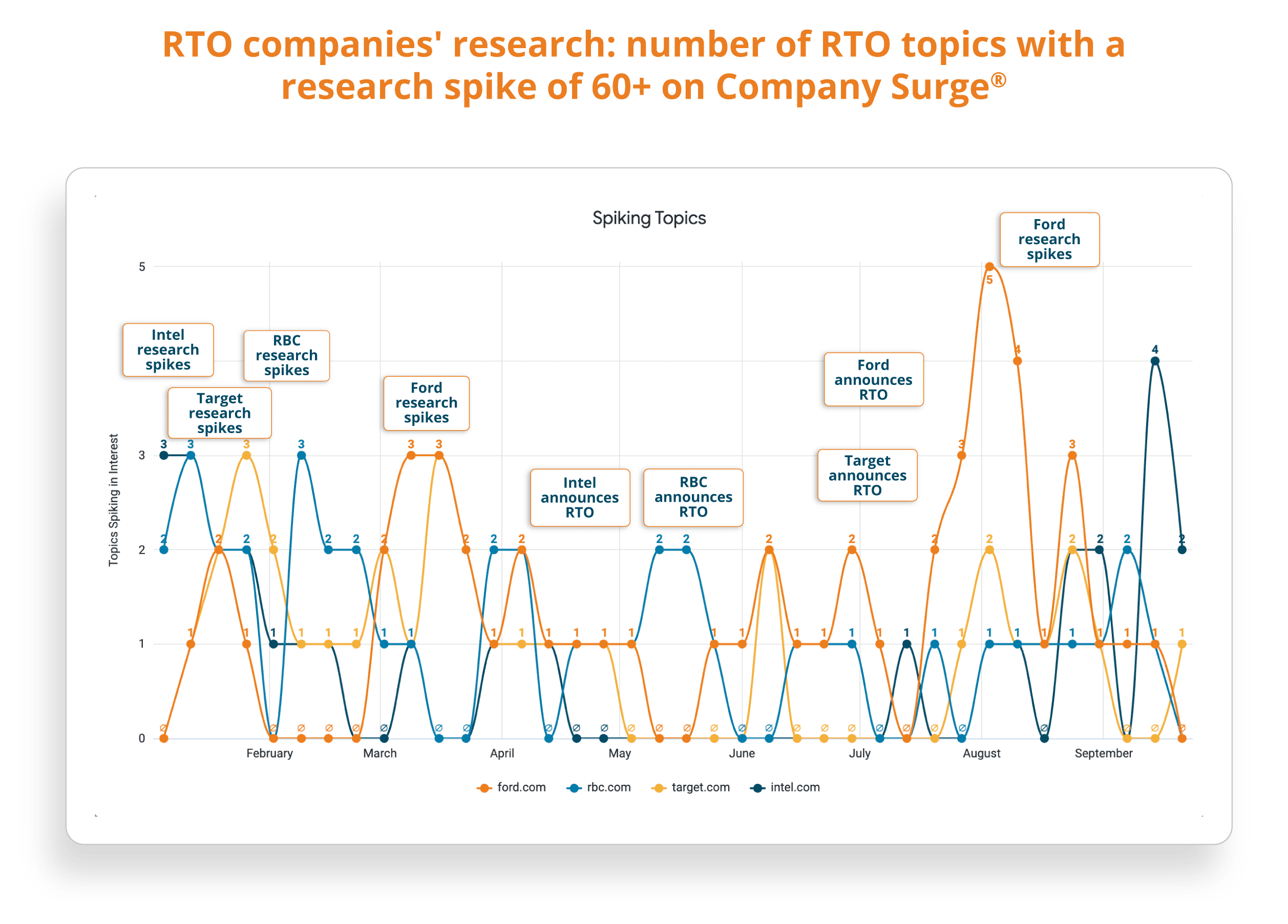

Inspired by Ford’s return to office (RTO) announcement, we took a look back to see if Company Surge® Intent data would have predicted this decision before it was made. We then looked at additional companies that had made 2025 RTO announcements and measured how often 6 topics related to return to work were spiking among these companies.

A research spike shows that companies were actively researching topics, meaning they had a Company Surge® score of 60 or higher.

RTO-related topics

The Intent topics we looked at reflect concerns of companies that are making RTO plans:

- Office lease

- Office space trends

- Downtown office space

- Office space

- Return to work

- Office furniture

Ford announced on June 25, 2025 that most of its corporate employees would be called back to the office 4 days a week.* There was a research spike on three RTO-related topics in mid-March about 9 weeks before the announcement was made. Another research spike of five RTO-related topics can be seen in early August, a month before the policy was implemented on September 1.

We compared Ford’s research with a sample of three additional major companies that ordered RTO in 2025.* Each company showed research spikes 8-10 weeks before the announcements were made on topics related to RTO considerations such as office leasing and office furniture.

How does the research compare for companies allowing remote work?

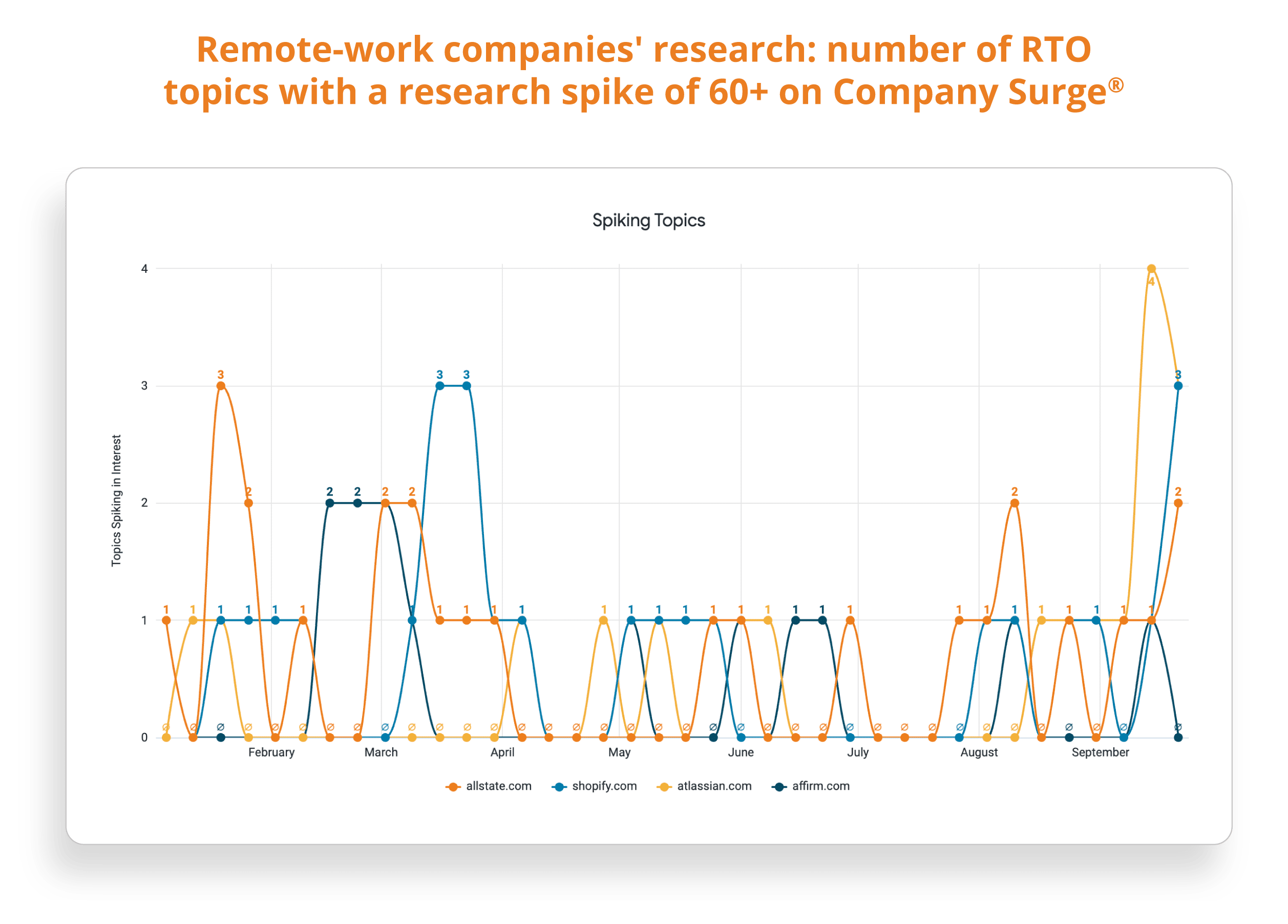

Are the companies that are continuing to allow remote work researching the return to work topics of office space trends, downtown office space, office space, return to work, and office furniture with the same intensity?

We see in the chart above that throughout 2025 there is considerably less research on topics related to RTO by companies who are committed to remote work. For example Allstate announced in April, 2024, that employees can choose the work location that’s best for them,* and the Intent data reflects that they are staying the course.

What are companies researching who are committed to remote work options?

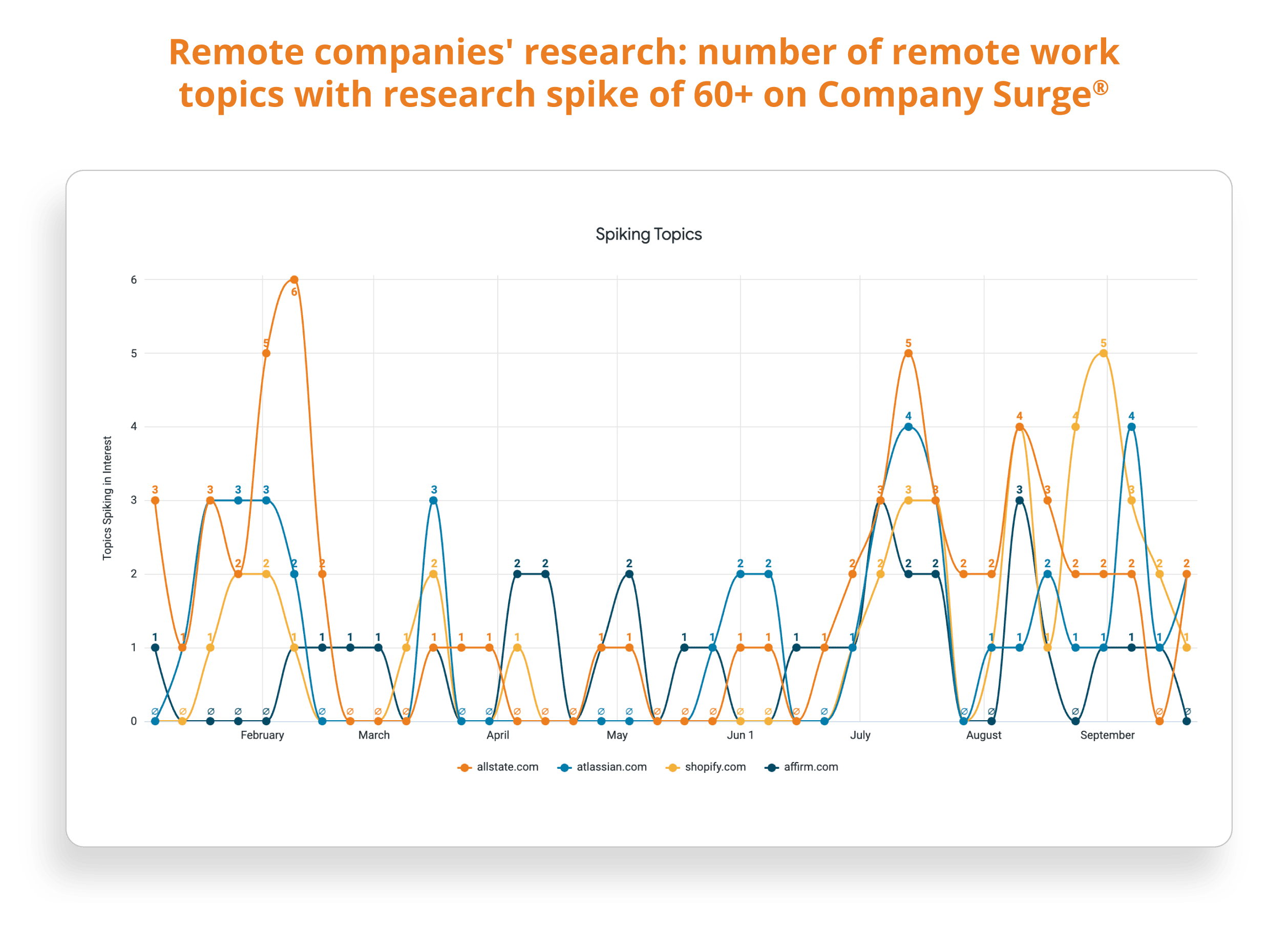

A different set of research topics was of interest to companies that are committed to remote work:

- Remote sales

- Remote office

- Employee performance

- Telecommuting and remote employees

- Work-life balance

- Employee engagement

- Remote working

- Remote accommodations

- Employee stress

- Remote onboarding

Companies that are promoting remote work show research spikes on the topics that are related to their commitment to “work anywhere” policies.

Conclusion

Bombora’s Intent data is a powerful resource for any organization looking to see directional signals in the marketplace. This comparison of research patterns of businesses favoring in-office policies versus those committed to remote work demonstrates that our data has a finger on the pulse of business.