Why and how publishers need to prove their value to survive 2023 and beyond

- 1 The data problem

- 2 The goal

- 3 Enter: Bombora for publishers

- 4 Contextual targeting and scaled audience extension — without needing user data and cookies

- 5 So, what does all this mean for you?

With ad budgets expected to slow for a second consecutive year, publishers must prove their value to customers beyond high-level views and clicks to keep from ending up on the chopping block.

Insider Intelligence revised their forecast on worldwide digital ad spend (they cut their original estimate in half from a 15.6% increase over 2021 down to only an 8.6% increase), and they decreased their estimate for worldwide digital ad spending for 2024 by $60Bn (from $756Bn down to $696Bn).

GroupM also cut their growth estimate for 2022 down to 6.5% (down from 8.4%) and put their outlook for 2023 at 5.9% (down from 6.4%).

Statista reports that while the market will continue growing through 2026, it will grow at a plodding, single-digit pace.

But, while the numbers continue to track upward, the view from our customers’ perspective is more nuanced: tighter spending puts more pressure on them to make more strategic decisions about where to invest.

Now more than in recent years, their investments need to lead to clear ROI…and fast.

Those that do will survive, while those that don’t will get cut.

The data problem

Unfortunately, tightening budgets isn’t the only challenge facing publishers in 2023.

The 2023 Industry Pulse Report from Integral Ad Science listed a bevy of challenges for publishers, from monetizing with or without social platforms to ensuring ads aren’t delivered alongside risky or misleading content to the possible disruption of generative AI, but several of the top concerns stood out:

- Decreasing access to consumer data/cookies (40%)

- Providing scaled audience extension, minimizing overhead (20%)

- Contextual targeting (19%)

…In actuality, these all funnel up to the same data problem:

How are publishers expected to deliver on ad effectiveness, recommend new audiences, and show value beyond views and clicks if they have virtually no information on visitors beyond their first-party data?

The goal

In the publishing industry, proven viewership is more critical than ever. Having an incomplete audience understanding means missing out on revenue, but profiling transient viewers can be incredibly costly to scale.

Understanding and analyzing audiences can help publishers demonstrate value and beat out the competition. For business publishers, real-time data about viewers’ business profiles, business concerns, buying-team rosters, and behaviors, in addition to general visitor data, is especially valuable as B2B marketing continues to evolve digitally and as account-based marketing (ABM) moves into the mainstream.

Knowing what, when, and why a prospect account is interested in purchasing enables more customized advertising and content delivery. Pre- and post-campaign reporting with this kind of detail about audiences can deliver specific business-audience value to advertisers or content creators.

But how is this feasible with ever-tightening user privacy regulations?

Enter: Bombora for publishers

Bombora has been long established as the leader in the Intent data space, primarily due to our fully-privacy-compliant Data Co-Op of over 5,000 of the top B2B sites on the web. Our unwavering commitment to data privacy has earned us a stellar ranking by Neutronian, placing us in the top 10% percentile with a remarkable score of 102.08 in the privacy and compliance category – significantly higher than the average score of 55.7.

By working directly with publishers (as opposed to working through the bidstream), we can provide our B2B customers with the highest quality Intent data while ensuring that it’s fully compliant and protects their visitors.

But our capabilities are only as good as the publisher partners in our co-op, and, as it turns out, this is a perfect solution to the data privacy/quality problem.

Here’s why.

Simply put, you can maintain or improve your current targeting and audience extension capabilities by accessing Bombora’s data without relying on cookies and Personal Identifiable Information (PII).

Why?

Because Bombora’s data doesn’t rely on cookies or PII to be effective (PII adds more hassle than help).

The value of Bombora has always been understanding where a business is in the purchase cycle, and that insight comes from how a business interacts with a topic over time. As buying committees continue to grow, we see regular and predictable consumption patterns from businesses that reliably indicate the business’s position in the purchase consideration process.

While the number of individuals from a business consuming content on a particular topic contributes to that insight, we don’t need to maintain information that specifically identifies each user (Therefore, after we obtain data from our publisher partners, it’s aggregated and anonymized, and then associated with a business domain so our model can conduct its analysis).

So, what does all this mean for you?

We could give you a load of rhetoric, but we figured we’d give you a few real examples instead.

Publisher spotlight: Informa Markets

Informa Markets noted that their customers’ most challenging problem was getting back too many leads with low intent — “You don’t want to have to talk to 200 prospects if only five of them are who you want to talk to,” said Len Roberto, audience and data management director at Informa.

So Informa started running their customers’ provided demographic data through Bombora’s Company Surge® Intent data to discover which criteria-meeting accounts were researching the relevant topics for their customers when they cross-referenced this account list with their own first-party data to uncover which accounts were most likely to respond.

It’s been working so well that Informa is considering running intent-only campaigns (without using demographic data), and they’ve even used Intent data for their internal marketing and prospecting processes by searching for businesses researching digital and programmatic advertising with great success!

“Bringing Intent data to the table makes our client relationships feel less transactional and more like a partnership. Like, we’re not just going to take your money and run your ad,” said Roberto. “We’re a partnership, and we’re going to continue working together to improve this.” |

Publisher spotlight: Area Development

“Companies that advertise with traditional publishers are often left with an empty feeling,” said Justin Shea, Digital Media Manager at Area Development, a leading corporate site selection, and relocation publisher.

Justin wanted to give his customers more bang for their buck, so he also started layering Bombora’s data over Area Development’s own first-party data.

Now, instead of just showing clicks, Justin can share details like engagement, viewership, and conversions by industry, business size, roles, and much more. “We can even give our advertisers a list of businesses engaging with their ads and showing interest in their products,” said Justin.

You heard that right. With the help of Bombora’s tools, tags, and data, Area Development can now produce a qualified lead list through a programmatic advertising campaign.

“On one of our latest campaigns, we were able to share a lead with a customer that resulted in a multi-million dollar deal and created over 200 nebs—all from using Bombora’s insights with the customer’s banner ad on our site,” said Justin.

“It’s typically not instant gratification in our industry,” said Justin, “but now I feel like a marketing business and a publisher all rolled into one.” |

Only the strong will survive

What does a publisher of the future look like?

Look no further than the two examples above.

With Bombora’s data and insights, publishers can answer client questions faster and with more value that previously couldn’t be answered.

Publishers can also play more of a consultative and partner role with their customers by providing recommendations about prioritizing audiences and content based on what topics customers’ target accounts are interested in.

And this is just scratching the surface.

So, how will you continue to deliver value amidst the rising data challenges?

Bombora is here to help.

Still not convinced or want to learn more?

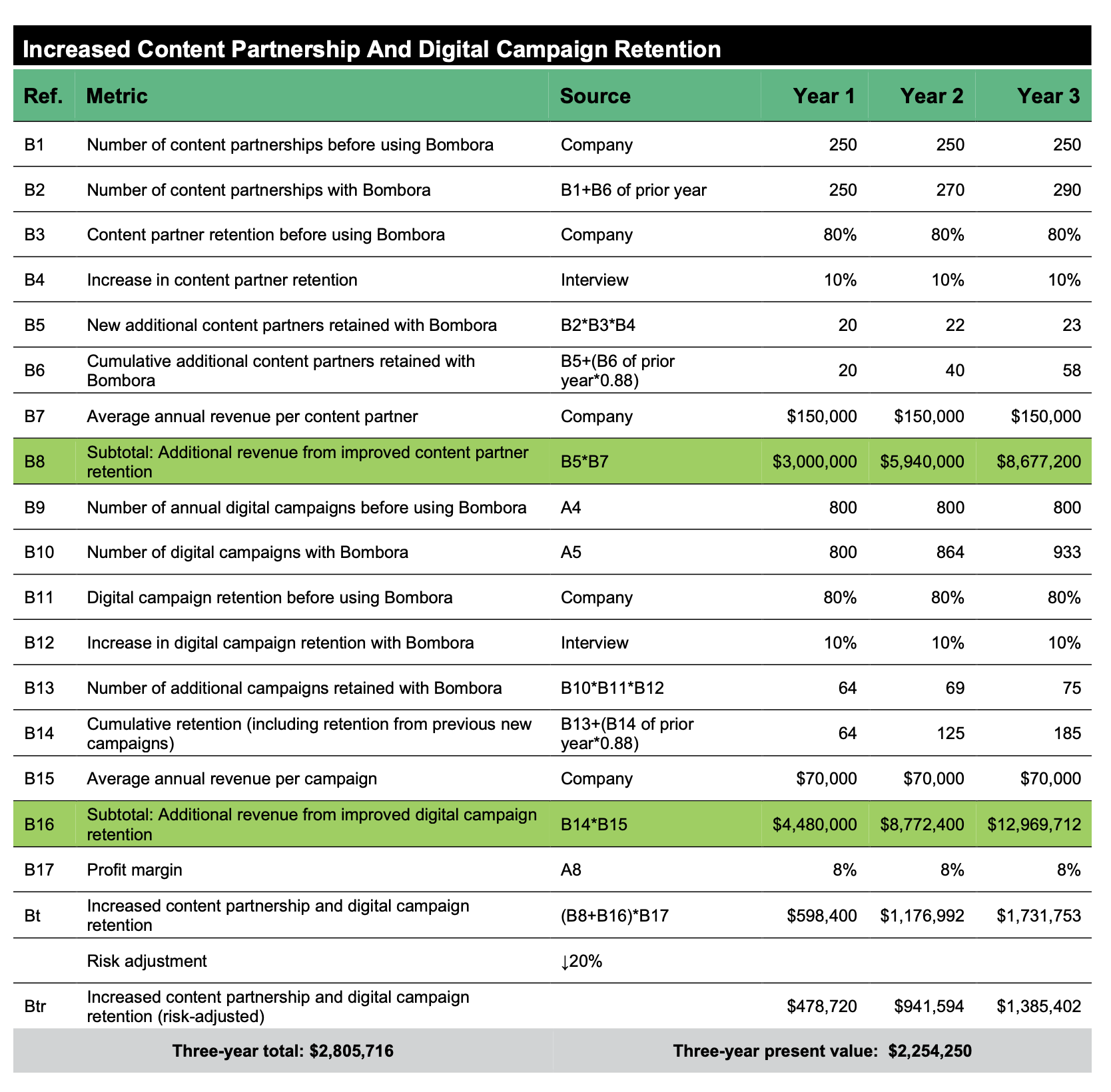

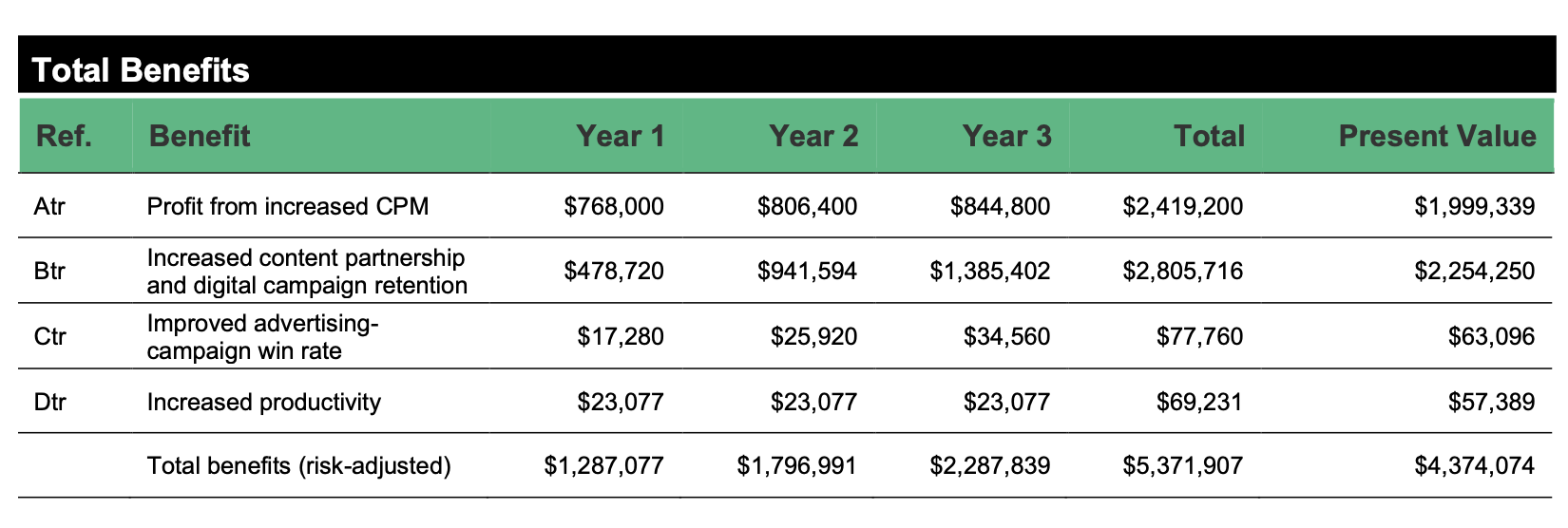

Grab our most recent Forrester Total Economic Impact Study here.