How B2B enterprise businesses are reacting to the current market trends, and what you can do to start 2023 strong

- 1 Where our data comes from

- 2 Customer expansion and RevOps categories taking priority over ‘brand and demand’ gen

- 3 Brand and demand: focusing on inbound

- 4 Increasing customer expansion and decreasing time to value (TTV)

- 5 Getting back to basics with RevOps

- 6 Maximizing value. Minimizing expenses.

- 7 Looking for growth? The right Intent data is the answer

Recession, gridlocked supply chains, spiking oil costs, rising interest rates, 40-year record-high inflation, and escalating war in eastern Europe — all these events are outside of our control, but they’re the cards we’ve been dealt heading into the end of 2022.

And we’re seeing the effects of this reflected in our Intent data, Company Surge®.

The good news is that the number of businesses that are actively researching ‘economic growth’ has risen 60% over last year. However, the number of businesses researching ‘economic downturn’ has also grown, but it’s grown twice as much (an increase of 119%). And it has completely overtaken growth research by volume.

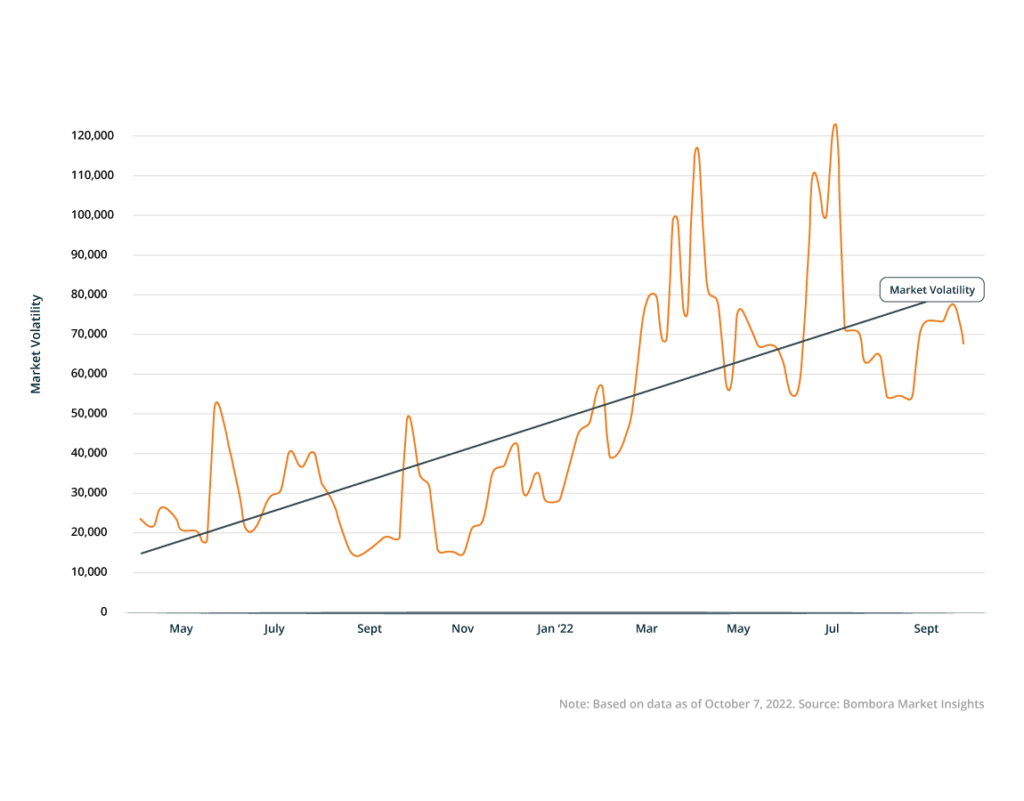

Similarly, research around ‘market volatility’ has grown 149% over this past year:

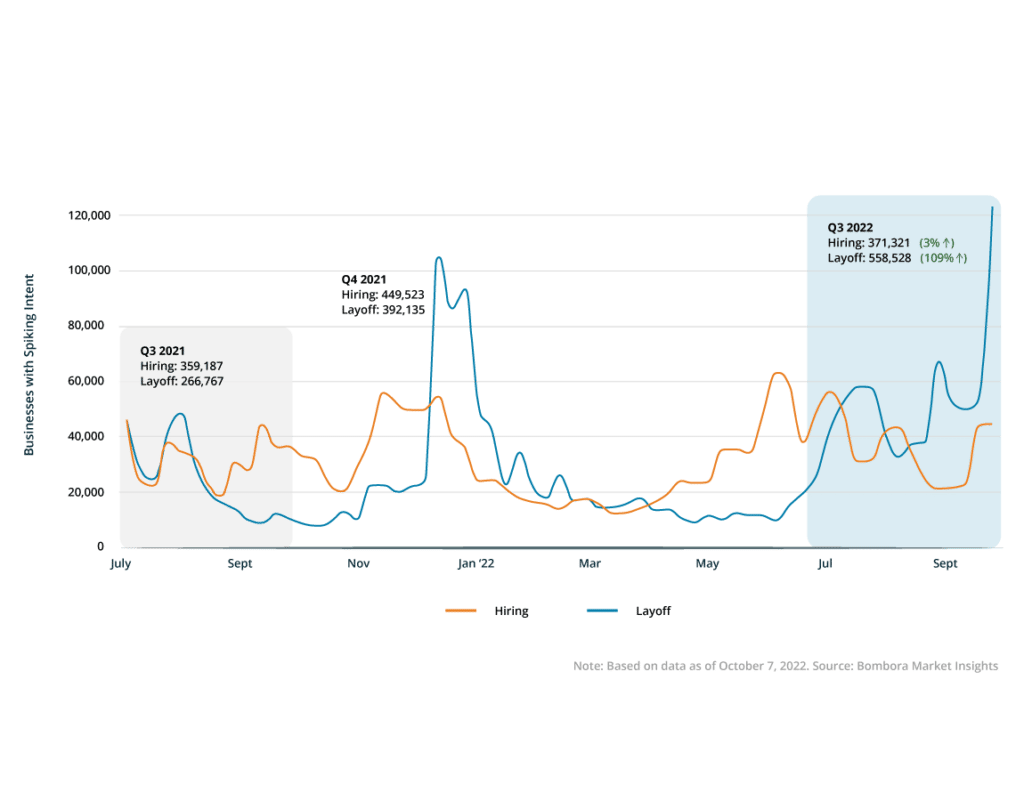

And research around ‘layoffs’ has grown 109% in Q3 (beating the typical year-end spike by 42%):

It’s clear from the data that businesses of all sizes and specialties are searching for strategies to weather the current market conditions, but what actions are they taking, and what can you do to best prepare yourself to hit the ground running in 2023?

Where our data comes from

Before we dive in, we wanted to take a second to let you know where this data comes from. While the opportunity B2B Intent data presents (especially during these turbulent times!) is great, not all collection practices in the B2B Intent data world are truly created equal.

At Bombora, we monitor content consumption at a business level through an exclusive collection of premium business publishers, analysts, vendors, and content syndication providers to produce the most trustworthy source of B2B Intent data — Company Surge®.

This content consumption captures nearly 16.4 billion interactions a month from almost 4 million unique domains across what’s called our proprietary and privacy-compliant Data Co-op — in fact, 85%+ of highly trafficked, research based B2B sites across the web is exclusive to our Data Co-op.

Why does this matter? What’s key here is that the internet is noisy with information that might not mean anything to your business growth (like cat videos).

But through Bombora’s Data Co-op, we analyze the highly trafficked, business internet. Search behavior is filtered to provide you with the most accurate and privacy-compliant B2B Intent data (without the noise) to showcase exactly what’s top of mind for businesses today.

Customer expansion and RevOps categories taking priority over ‘brand and demand’ gen

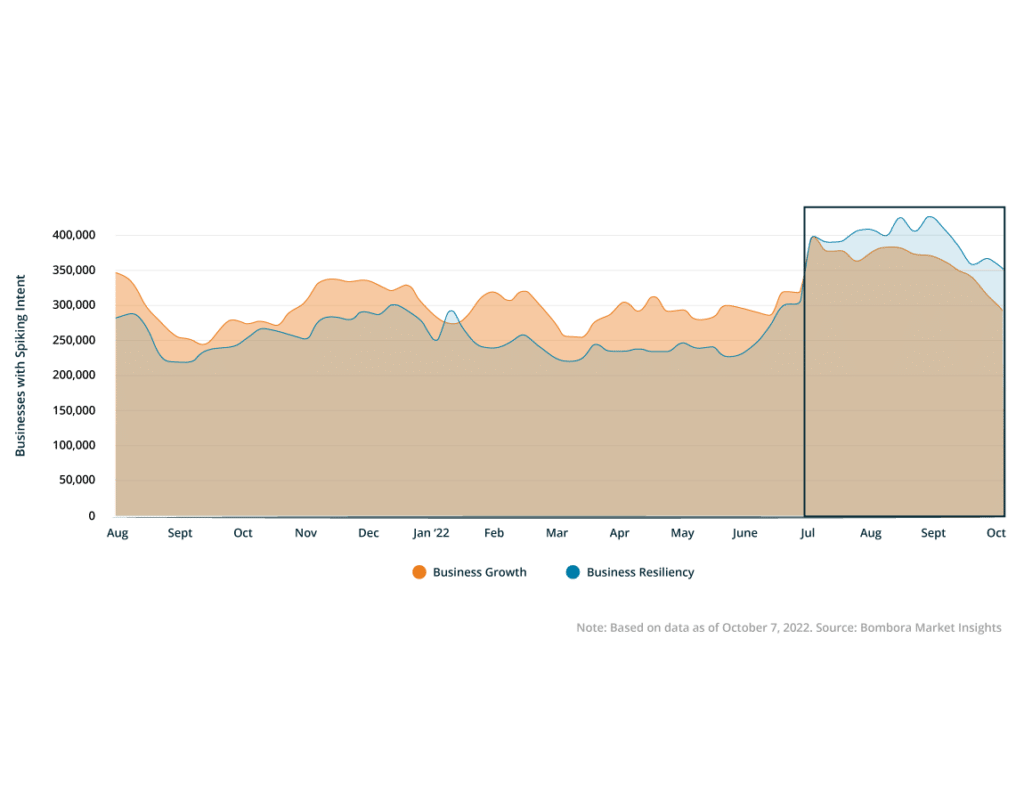

In general, what we’re seeing is a shift in focus from business growth to business resiliency. In fact, July 2022 actually marked the first time we’ve seen the volume of searches for resiliency surpass those for growth:

So, instead of focusing on advertising and launching new products, B2B businesses have been investing more of their time and energy into understanding how to maintain their current business through retaining their customers, encouraging renewals, and other strategies.

And we can see this play out in the specifics of what’s being researched.

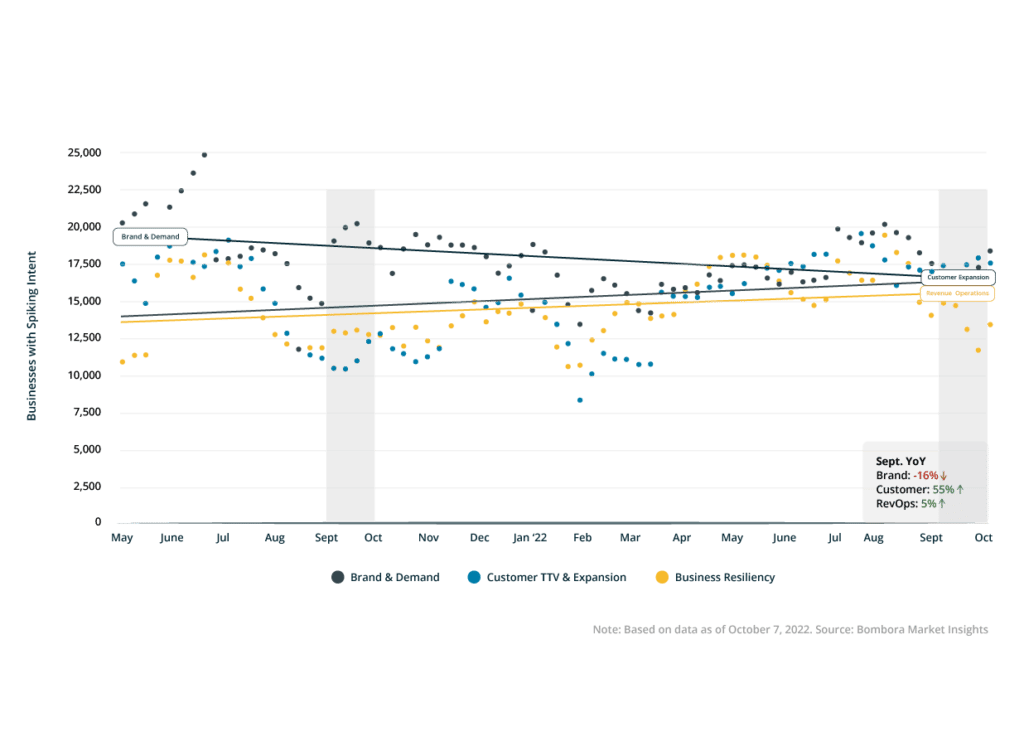

Traditionally, ‘brand and demand’ was the primary focus for businesses, with searches related to customer expansion and revenue operations trailing behind, but after the events of this past year, searches for these ‘brand and demand’ topics have dropped 7%, while the number of businesses researching topics related to customer expansion and RevOps increased by double digits (13% and 16%, respectively).

Now these topics are almost at parity, which is a big shift from last year (when the number of businesses researching ‘brand and demand’ topics was 50% higher than those searching the more maintenance-focused topics):

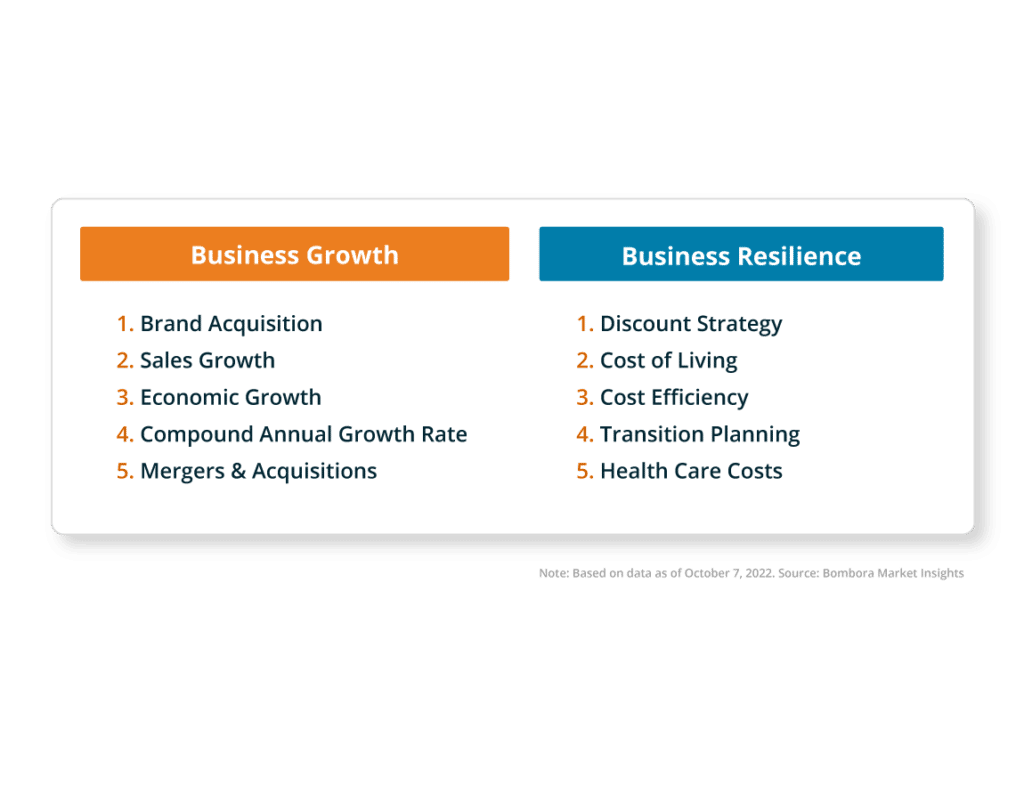

For reference, here are some of the primary topics being researched for business growth and business resilience:

Notice how the topics in the business growth category are focused on acquiring new customers, while the resilience topics on the right are more focused on lowering the bottom line.

Brand and demand: focusing on inbound

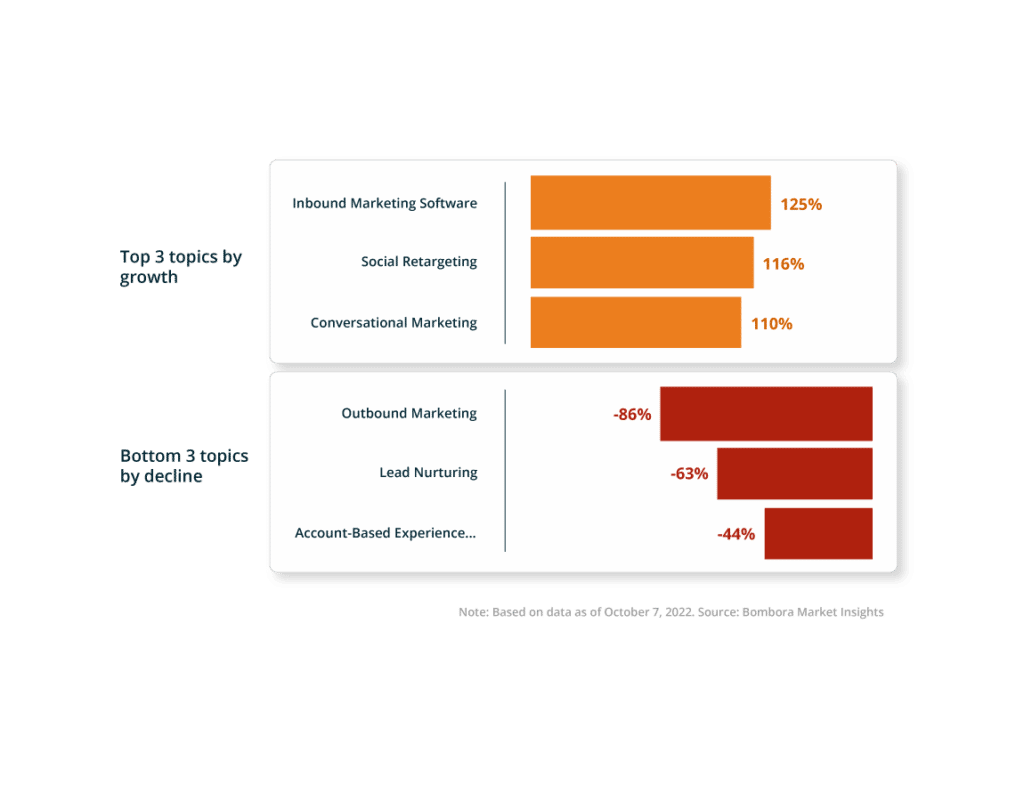

Obviously, the research into ‘brand and demand’ strategies didn’t go away. It just shifted.

Now the focus is more on inbound efforts, and it’s easy to see why:

Businesses still want new business, but they want to be more efficiently capturing and capitalizing on every lead that comes into the pipeline. This can be seen in the increased research into retargeting and conversational marketing strategies and the increase in interest in general inbound marketing software.

Increasing customer expansion and decreasing time to value (TTV)

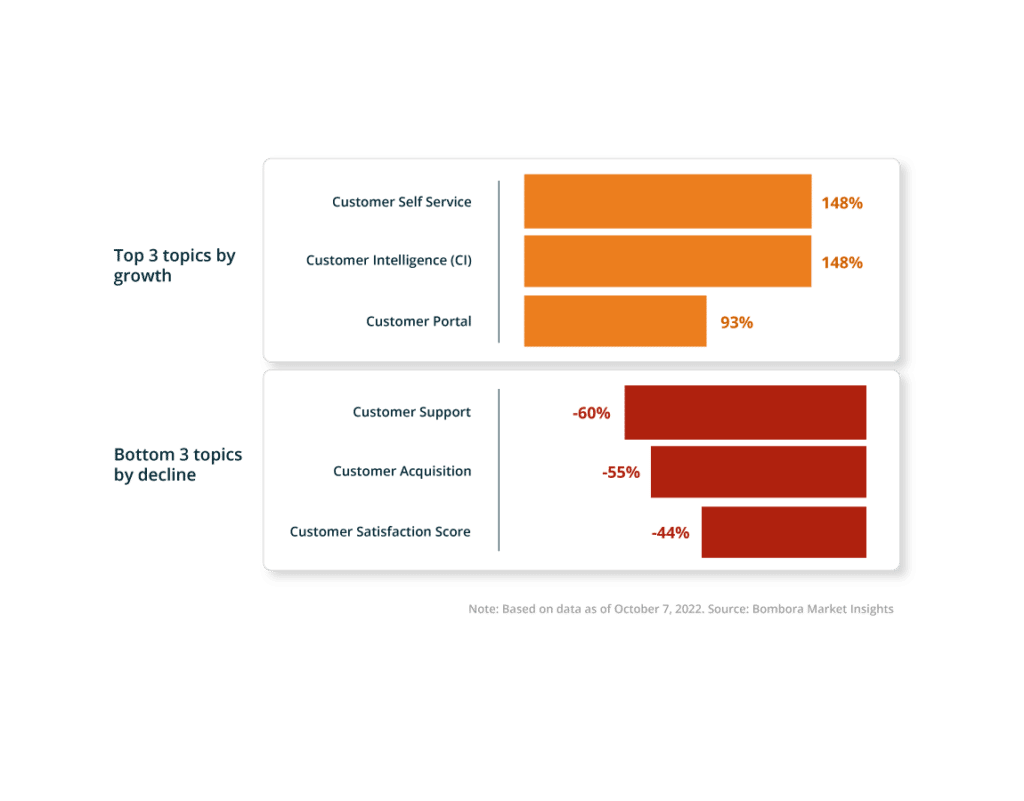

In addition to inbound efforts, other levers businesses can pull are customer expansion and reducing customer TTV.

Customer expansion involves creating more value for your business by selling your existing customers more of your product or service. Customer TTV is the time it takes until the ‘Aha! moment’ when a customer realizes the expected value of your product.

Businesses are looking to accomplish both of these goals through investments in customer support automation vs. traditional customer support, which aims to maximize efficiency while also lowering overall customer support costs.

Getting back to basics with RevOps

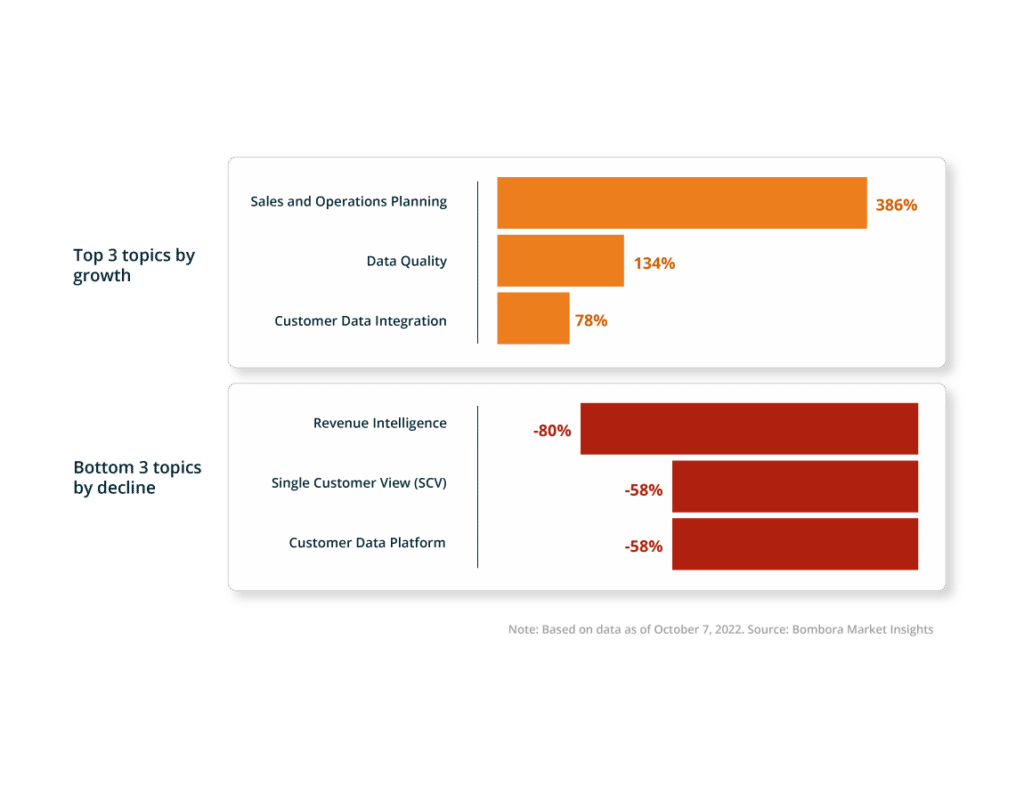

Of all the topics in the categories we explored, none saw as big of an increase in focus as the “sales and operations planning” topic, which experienced a 386% increase in the number of businesses researching the topic (a whopping 2-3x higher than any other in the ‘brand and demand’ or customer expansion category).

So, why the big spike of topics in the RevOps category?

Because it signifies going back to basics. RevOps means aligning sales, marketing, and customer success across the full customer lifecycle to drive growth through operational efficiency and keep all teams accountable to revenue.

It focuses on basic but powerful questions like ‘how do we get customers?’ and ‘how do we keep them?,’ and optimizes those processes.

As we can see from the data, during times of uncertainty, businesses are less focused on casting wide nets for new customers and taking big risks, and more focused on squeezing the value out of the customers they already have in their pipeline.

But what’s the best way to accomplish both of those goals simultaneously?

Maximizing value. Minimizing expenses.

While there are several ways businesses can increase their sales and marketing efficiency while reducing their expenses, Company Surge® is the only type of Intent data that provides awesome returns across the entire funnel, while avoiding the potentially negative effects that often follow layoffs and restructuring.

Here’s a quick glance at how Company Surge® offers advantages at each stage of the marketing and sales process:

Account prioritization

To get the biggest bang for your buck, you need your outbound efforts to be as efficient as possible. You can’t just throw your sales development reps (SDRs) and sales teams an unweighted list of prospects. Company Surge® allows you to identify which prospects on your list you should reach out to first by understanding which prospects are currently researching topics related to your offerings.

See how Fortinet uses Company Surge® to achieve better account prioritization.

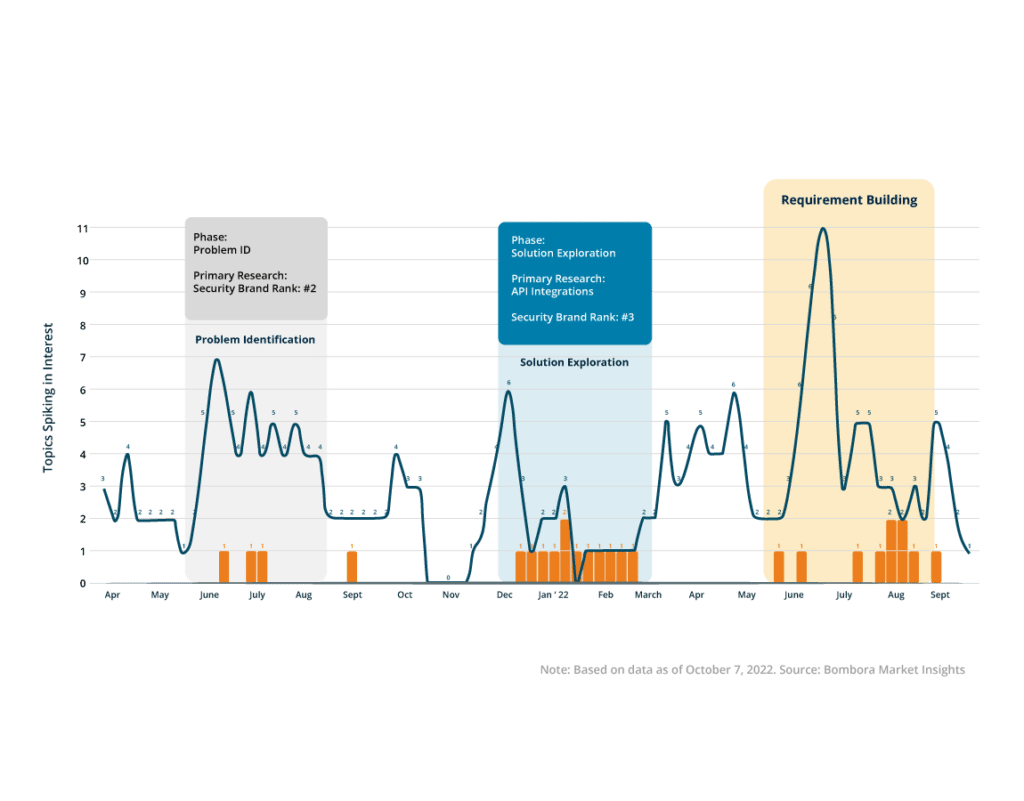

Account intelligence

It’s not just knowing when and who to call; you need to meet your prospects where they are in their buying journey. By knowing which topics your account is interested in, Bombora can help you understand at what level to approach your customer and what collateral will be the most helpful for them in their particular stage of the buying journey.

See how Snowflake boosted its SDR meeting creation rate by 4x and Kazoo got 2-3x increase in its outbound emails by using Bombora Intent topics!

Upselling and cross-selling

As mentioned, customer expansion is key, as it’s far easier and more efficient to sell to one of your existing customers than to bring on an entirely new one. Use Company Surge® to understand if your existing customers are researching topics related to any of your complementary offerings, and approach them for an upsell opportunity before they find a solution elsewhere!

Media planning and content curation

The most effective advertising speaks directly to your prospects’ interests and concerns. With Company Surge®, you can increase the efficiency of your advertising efforts by understanding which specific topics your prospect is researching, and serving the ads and collateral that are the most interesting to your prospect at that present moment.

Hushly saw a 498% jump in CTR (compared to using LinkedIn targeting alone) while realizing a 79% reduction in cost per click (CPC). Using Bombora’s Intent data, Salesforce achieved a 271% ROI on paid social.

Market sizing

During uncertain times, proper forecasting is key. Don’t automatically assume an account is an active in-market target just because it meets your demographic requirements. Incorporating Company Surge® into your market sizing exercises will ensure you’re only accounting for those targets who are actually ready to buy.

Churn reduction

A key step to maintaining your business is increasing retention and reducing churn. Use Company Surge® to understand if any of your existing customers are researching competitive products so you can proactively step in and keep them engaged before it’s too late! (Click here for a quick Deep Dive webinar on how to do that.)

See how Triblio used a combination of competitive topics, specific-use case topics, and even geography-specific topics to grow its number of leads per account by 2x.

Measurement

How do you know your advertising dollars are making an impact? Layering your first-party data with Company Surge® allows you to track how many of your targeted prospects become actively in-market after seeing your advertising. This provides a solid benchmark for campaign performance while helping you justify your value and your marketing budget for next year.

Inbox Insight’s planning process begins with the strategic support of Bombora’s Co-op Success team — by conducting a 3-, 6-, and 12-month lookback using Company Surge® to identify the strongest Intent trends and firmographics within its customer’s ICP list.

Looking for growth? The right Intent data is the answer

Before you contemplate drastic actions like heavy discounts or budget cuts, consider the efficiencies that Bombora’s Intent data can provide to every stage of your sales and marketing process.

Company Surge® can increase your outbound effectiveness and maximize the value of your existing customers by letting you speak to the right customers about the topics they’re most interested in at the appropriate stage of their buying journey:

So, don’t sink hours into aimless cold outreach or poorly targeted ads; request a demo today and we’ll show you just how incredible life with the right Intent data can be.

See more B2B resiliency Intent data resources

Establishing Intent data benchmarks for success

Get the formulasThe intentional lead scoring workbook

See the ungated workbookHow to do more with less: 3 ways to accelerate B2B growth with Intent data

Do more with less